DUBAI, 17 February 2026 (Gulf Daily) — Indian-owned businesses maintained their dominant position as the top source of new foreign companies joining the Dubai Chamber of Commerce in 2025, according to a fresh analysis by Dubai Chambers.

A total of 18,486 new Indian members registered throughout the year, marking an 11% year-on-year (YoY) increase. This extends India’s consistent lead seen in earlier 2025 periods: 4,543 in Q1, over 9,000 in H1 (14.9% YoY growth), and 13,851 in the first nine months (13.9% YoY), underscoring deepening economic ties bolstered by the UAE-India Comprehensive Economic Partnership Agreement (CEPA) and Dubai’s role as a gateway for South Asian entrepreneurs.

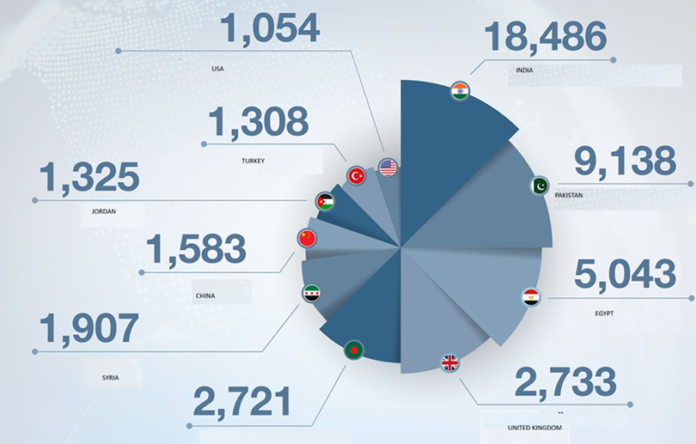

Pakistan secured second place with 9,138 new registrations, reflecting a strong 12% YoY rise. Egypt ranked third with 5,043 new companies, followed by the United Kingdom (2,733, +5% YoY) and Bangladesh (2,721, +15% YoY)—the latter showing one of the highest growth rates among top nationalities.

Syria placed sixth with 1,907 new members, China seventh with 1,583 (+7% YoY), Jordan eighth with 1,325, Türkiye ninth with 1,308, and the United States tenth with 1,054.

Overall, the Dubai Chamber of Commerce welcomed 71,830 new companies in 2025, boosting its active membership to 292,486 by year-end—a robust 13.2% annual increase from 258,318 in 2024. This growth highlights Dubai’s enduring attractiveness as a global business hub, driven by zero personal income tax, streamlined company setup processes, world-class infrastructure, strategic location bridging Asia, Europe, and Africa, and investor-friendly policies including golden visa options.

Sector-wise, Real Estate, Renting, and Business Services led new member activity at 37.6%, fueled by Dubai’s booming property market and consultancy demand. Wholesale and Retail Trade followed closely at 34.5%, reflecting the emirate’s status as a premier re-export and trading center amid rising e-commerce. Construction ranked third with 17.2%, aligned with ongoing mega-projects and urban expansion. Social and Personal Services accounted for 7.9%, while Transport, Storage, and Communications took 7.2%.

These figures reaffirm Dubai’s strategic importance under the D33 Economic Agenda, positioning it as a top destination for diversified foreign investment and entrepreneurship from emerging markets.